Microfinance Products

The company has two major products, Gati and Pragati. Gati typically includes loans of Rs.8,000 to Rs.14,000. Pragati comprises higher ticket loans ranging from Rs.15,000 to Rs.20,000, disbursed predominantly for income-generating activities.

DISHA MICROFINANCE

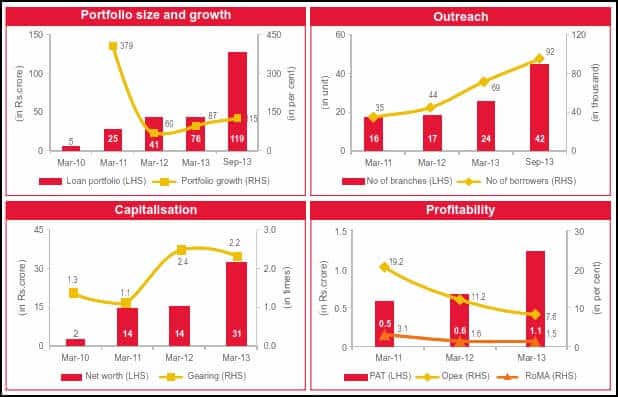

The company operates through a network of 42 branches in Gujarat and had a loan portfolio of Rs.119 crore as on September 30, 2013.

Performance on key parameters

The loan portfolio and borrower base grew at a CAGR of 143 and 128 percent respectively during the 3 years ended March 31, 2013. To improve geographic diversity, the company has ventured into Madhya Pradesh and Rajasthan Asset quality remains healthy with 30+ dpd never exceeding 0.25 percent since inception Relies predominantly on wholesale funding from banks/financial institutions, and securitization for funding; securitization accounted for nearly 20 percent of its borrowings outstanding as on March 31, 2013 Capitalization remains adequate for the current and planned scale of operations. The company raised Rs.15 crore of additional capital (share application money received, allotment pending as on March 31, 2013) from Indian (IV) Mauritius Holding Ltd, having nearly 47 percent stake Profitability is moderate, reflected in return on managed assets of 1.5 percent during 2012-13; however, the ability to maintain profitability under the revised regulatory regime will be critical

DISHA MICROFINANCE PROFILE