These were just the plans, but now the major question is which mutual fund you should invest in? After the market correction in 2022, valuations in many categories have reached attractive levels, opening up opportunities for fund managers where India’s top-performing mutual funds would deliver high returns to investors in 2022.

10 Best Direct Mutual Funds For High Return In 2022

In this article, we will discuss the ten top-performing direct mutual funds to invest in 2022, but before we move ahead with the article, let’s first understand what direct mutual funds are? Direct mutual funds plans are the best option for those who wish to invest in the funds directly without any intermediary. Here, by reducing the expense ratio, the fund managers can generate better returns. Well, if the commission is removed, then it automatically increases the returns over the long term. In the direct plan, investors will have to do their own market research and choose the top-performing mutual fund schemes. Investors can always reach out to mutual fund websites and blogs to know more about mutual funds’ schemes.

Let’s compare both regular and direct plans?

The direct plan and the regular plan has one major difference, which is the expense ratio. Scheme traits such as risk factor, investment objective, investment strategy, facilities offered, and terms & conditions, including the exit load structure, are the same for both types of the fund. If you are investing in a regular plan, the mutual fund houses charge a commission that they need to pay to the distributors for getting them the business. Generally, the commission is between 0.8% to 1.5% yearly and are transferred to the investors by reducing their mutual fund NAV. Now the direct plan is an effective and smart choice for any investor. In this plan, you are directly investing in the mutual fund with the fund house without paying any commission to the agents/brokers/ distributors. Here, you will reap the 100% benefit of your investment that would lead to a massive difference over time. For instance, Axis’ long-term Equity Plan announced an annual return of 40.4%, while the direct plan for the same fund has delivered a 42.2% annual return. As an investor, you are not supposed to underestimate the huge impact of this minor difference. Even a 1% difference can be a huge gap with the compounding effect in the long-term.

How to choose the Best Direct Mutual fund for 2022?

Mutual funds investment may be risky, but they have the potential to provide higher returns than many other investment options. However, choosing the right direct mutual is a daunting task, and there are some very important factors, such as Diversification, returns, risk, liquidity, etc., which you need to analyze thoroughly. These parameters will help you judge the potential of a mutual: a) Identify the Financial objective/goal Are you looking to make a long-term investment or a short term investment? Do you want to save for educational expenses, or are you planning to retire? There are more than 1500 mutual fund options in the market. Before you make an investment, it is crucial to identify your financial goal. For example, if you want to save for your retirement, then you must prefer to invest in a long-term scheme (probably more than 10-15 years). While, on the other hand, if you are saving to buy a property or car, then you would need to invest in a medium-term fund (probably 3-5 years) b) Risk Tolerance You all must have heard these lines, “Mutual funds are subject to market risks. Please read the scheme related documents carefully.” Always remember, the risk is another major factor that influences your investment decisions. A majority of investors do no indulge in market risks, whereas, there are a few investors who are willing to take high risks and believe in generating high returns. New investors with no knowledge of the market should invest in funds that are not too risky, such as Debt funds or Large Cap Equity Funds. Large Cap Funds invest in companies with large market capitalization, which makes them less prone to market volatility. And the debt funds invest in Government Securities/corporate bonds, which makes them less risky as well. However, if you are more concerned about returns and comfortable in taking high risks, then you can invest in funds that give high returns such as Mid Cap Equity Funds or Small Cap Equity Funds. Always know that no mutual fund is entirely risk-free. Even debt funds are somewhat prone to interest risk and credit risk. You can diversify your portfolio as it will mitigate the overall risk involvement. c) Fund Performance Looking at the past performance of the fund is a good parameter of judging the potential of a fund. You need to observe and analyze the performance the fund has maintained over the duration of a particular time period. The returns over the past three to five years period can help you determine the performance of the benchmark and returns accrued by the fund as well. However, you should be aware that the past performance of the fund is not indicative of its future returns. d) Assets under Management (AUM) & Costs Assets Under Management (AUM), define the total number of assets the funds hold, the size of the fund and subsequently invests in securities. It showcases the potential and capability of the fund because of which the investors are investing in that particular fund. A fund with a high AUM is exposed to market risks. Other costs such as Expense Ratio and Exit load must also be considered as these charges are drawn directly from your returns.

Expense Ratio: The cost incurred for portfolio management. Exit load: This cost is incurred/charged at the time of redemption of fund units.

According to SEBI, if the maximum expense ratio is 1.5%, then it is considered good. e) Managerial Expertise If you are betting in Mutual Funds, then you would require expert management. Some funds are managed actively while some funds are managed passively. Before finalizing any scheme, you need to determine how your fund will be managed. Managers follow critical research procedures for evaluating and analyzing different sectors, economic trends, companies, etc. The fund manager must have enough experience to understand market movements, to place good bets, and obtain sufficient returns.

10 Best Direct Mutual Funds for High Returns in 2022

1. Axis Bluechip Fund

This is a 9-year old Large-Cap Fund that has outperformed its category average during year 1 year, 3 years, as well as 5 years.

Axis Bluechip is a highly conservative large-cap fund with all its portfolios placed in large-cap stocks. The maximum exposure in this scheme is in the Financial Services Sector (44.18%), FMCG (6.40%), and technology (8.97%) sectors. HDFC Bank (8.88%), ICICI Bank (8.36%) and Kotak Mahindra (8.05%) are the top holdings of this scheme. Mr. ShreyashDevalkar manages this scheme since November 2016.

2. PPFAS Long Term Equity

PPFAS is a multi-cap equity fund, with around 89% of its assets invested in equities, which include arbitrage. Since SEBI multi-cap fund’s equity requirement is that 65% of assets should be invested in equity, which means it meets the requirement marginally.

The fund manager follows a deep-rooted value investing principle. The arbitrage inclusion in this scheme helps in reducing its risk by benefiting from hedging. Considering the value investing approach, unique asset allocation, and the extraordinary performance of this scheme, this scheme is a must-have multi-cap fund. During the 1 year and 3 year periods, this scheme has outperformed its benchmark. The financial sector has the maximum exposure in this scheme, which is 31.13%, followed by Technology(23.78%) and Automobile (13.30%). Mr. Rajeev Thakkar has been managing this scheme since May 2013 and has Alphabet Inc(9.42%), HDFC Bank (9.17%), and Bajaj Holdings & Investment (8.81%) as its top holdings. You must invest in PPFAS Long Term Equity Fund if you are looking for a high performing multi-cap fund.

3. HDFC Small Cap Fund

This fund has around 72% of its assets invested in a small-cap stock with around 25% mid-cap holding and 2% large-cap holding. This makes it one of the aggressive funds.

It has around 12.5% in debt cash holding. Therefore, it is one of the relatively aggressive small-cap funds. This scheme follows a balanced approach—the weightage is equally divided into defensive sectors, including Software and Entertainment, as well as consumption-driven, such as Banking. NIIT Technologies(3.33%), Inox Leisure(2.73%), and Sonata Software (2.98%) are the top holdings of this scheme. It is a must-have small-cap fund that has given impressive returns in both long term and short term.

4. Franklin India Prima Fund

This mid-cap fund has been in the market for 25 years now and has always performed better than its category average and benchmark during the last 7 year period. It had generated returns of 9.57% during the period of the last 5 years, which is more than both its benchmark and category average. It has invested around 81% in mid-caps, 7% in small-caps, and 13% in large caps. Cyclic sectors like Engineering and Financial are given high weightage than defensive sectors like Pharmaceuticals. HDFC Bank(3.52%), Kotak Mahindra Bank(3%), and City Union Bank (2.99%) are the top holdings of this scheme. Also Read: 10 Best Mutual Fund Apps to Invest Online in India Mr. R Janakiraman managed this scheme for over 5 years. This is a good choice if you want to invest in the mid-cap category as it has performed extraordinarily in the long term.

5. Axis Long Term Equity

Axis Long Term Equity Fund is one of the best Direct Mutual Funds in India (2022). This is an ELSS fund that 11 years old, with a massive AUM(Assets Under Management) of INR 21,160 Crores of Nov 30, 2019.

In the 1 year period, it had generated a return of around 24.65%, which is almost 11% more than its category average of 13.05% and 14% more than its benchmark of 10.30%. In the 5 year period also, it has outperformed its category average and benchmark by generating a return of 12.23%. This is an aggressive ELSS scheme with around 76% of its assets invested in large caps, 22% mid-cap, and 1.64% in small-cap holdings. It follows an aggressive approach, even in the sector-wise allocation, as its investment in consumption-driven sectors outweighs counter-cyclical sectors. Bajaj Finance(9.08%), Kotak Mahindra Bank(8.43%) and HDFC bank (7.78%) are the 3 top holdings of Axis Long Term Equity Fund. This scheme is also a must-have as it has a strong portfolio.

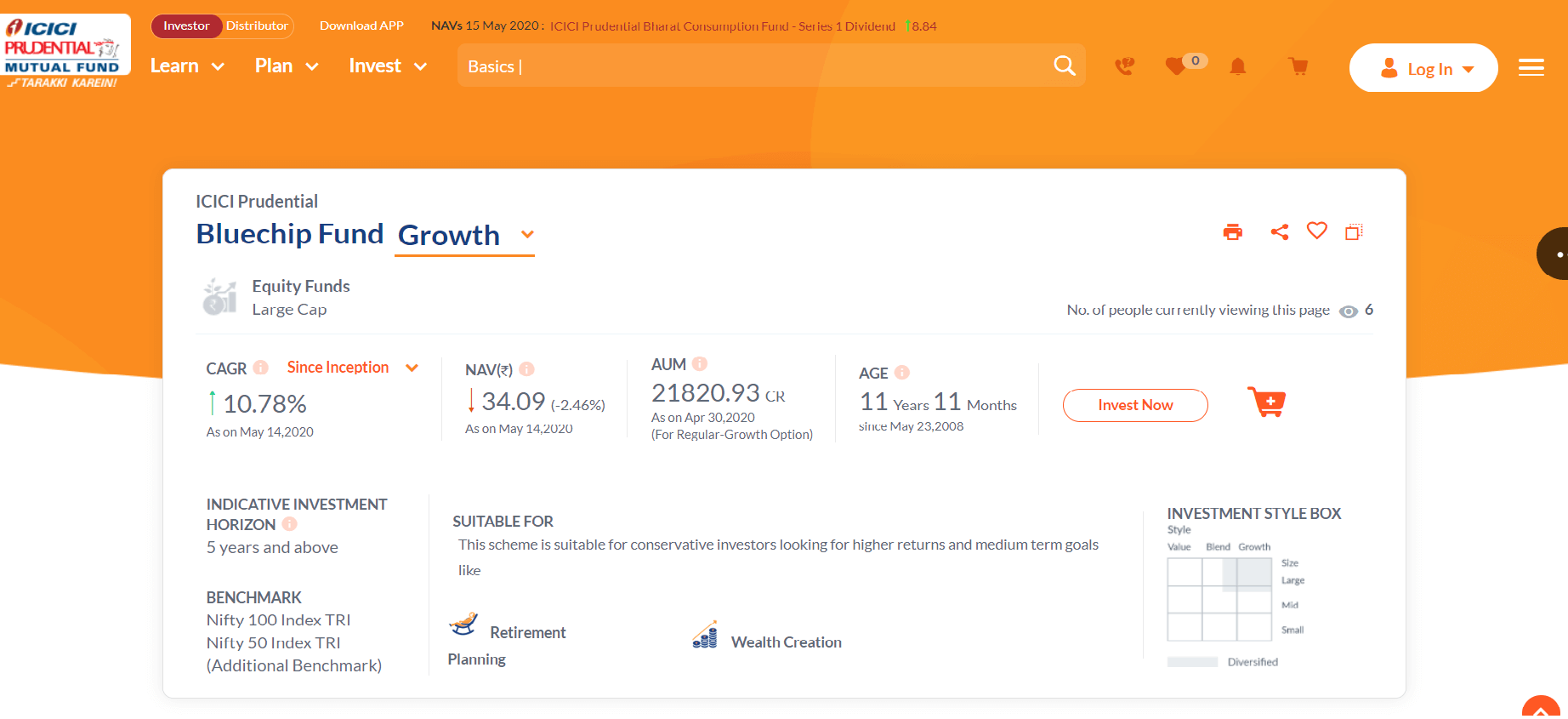

6. ICICI Prudential Bluechip Fund

This is an open-ended mutual fund scheme that invests more than 85% of the total assets in equity stocks large-cap companies. Its investment objective is long term capital appreciation. The fund mostly invests in high growth blue-chip company and follows a ‘buy and hold’ approach. It has a well-diversified portfolio across various sectors, with top performers from each industry being a part of the portfolio. ICICI Bank, HDFC Bank, and Infosys are some of the top holdings in this scheme. If you are an investor who is looking for reasonable returns from a particular investment horizon (4-5 years), then this scheme will prove to be a good option for you. If you are a newbie or you are someone with not so much knowledge about financial markets or don’t have time to track the market regularly, then you must opt for this fund to invest in India’s leading companies. The ICICI Prudential Bluechip Fund has delivered quality returns in the long run. This fund offer investors the opportunity to grow their savings with the growth of leading companies.

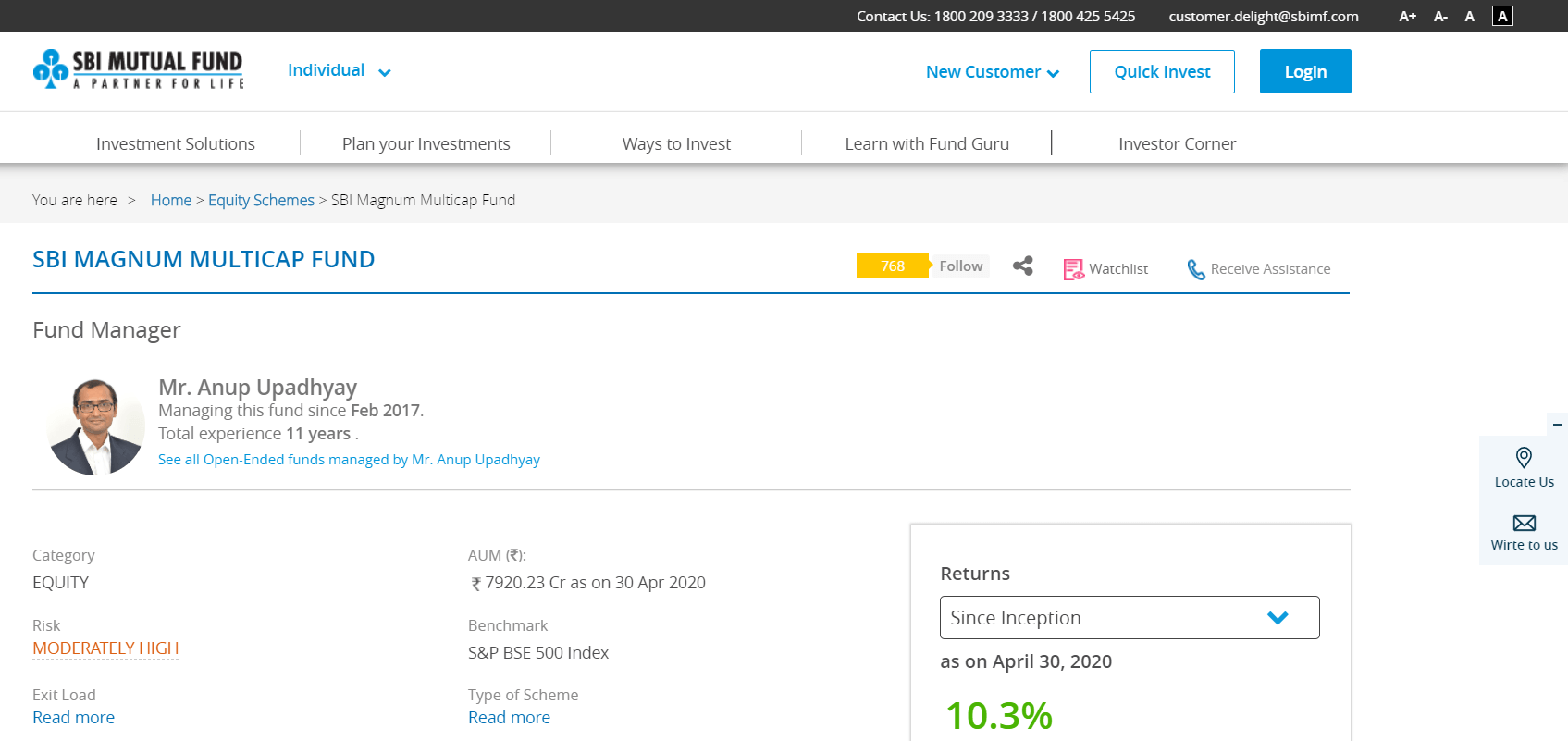

7. SBI Magnum MultiCap Fund Direct-Growth

This is another open-ended equity mutual fund scheme. SBI Mutual Fund Asset Management Company invests over the market capitalization spectrum. It has invested around 65% of its assets in equity related instruments and equities, and the remaining 35% is invested in Debt and other money-making instruments. This scheme invests in company stocks of small-cap, mid-cap, and large-cap funds. Around 50%-90% of the assets are involved in Large Cap Stocks, while approximately 10%-40% is allocated to mid-cap, and the other 10% is allocated to small-cap. The objective of the firm is to provide investors an opportunity for long term growth in the capital with the help of active management of a diverse portfolio along with sufficient liquidity. Investors who are looking for optimum portfolio compositions, maximum benefits from investments, capitalize on high returns from their equity investments, and long term capital appreciation. However, there are market risks associated with equities when they might not perform as expected.

8. Aditya Birla Sun Life Tax Relief 96 Direct

The scheme aims to provide long term capital growth and invests approximately 80 percent of its assets in equity while the remaining will be invested debt and money market instrument. It was converted to an open-ended scheme in July 1999, and it follows a top-down & bottom-up approach in the stock selection process. Aditya Birla Sun Life Tax Relief Fund offers tax benefits as it is an Equity-linked Savings Scheme. Mr. Ajay Garg is the fund manager and has a portfolio of the historical performance of over 22 years in managing funds in the equity market. This scheme has a lockin period of 3 years only and provides easy redemption, which makes it good for investors who are looking for an investment horizon of 3 to 5 years. Since it is an ELSS fund, investors earn higher returns while beating the effects of inflation. Therefore, investors who are looking to generate income and capital appreciation over the long term should consider this fund. Since it is an equity fund, it is subject to market risks. However, it is a multi-cap fund, so there is moderate risk involved in this fund.

9. L&T India Value Fund Direct-Growth

The aim of this scheme is to generate long term capital appreciation from a diversified portfolio of equity and equity-related securities in the market. This is an open-ended mutual fund scheme with the objective of generating returns by following the value investment strategy. It focuses on undervalued securities in the Indian Capital Markets. Also, some portion of the total AUM is invested under foreign securities as well. Investors with a decent knowledge of value investment strategy and who understand its basics can opt for this fund. Even investors who own a bunch of growth-stocks as a part of their portfolio can also opt for this fund to diversify their portfolio. Investment in this scheme carries a high risk because there are fair chances that the bets placed on undervalued stocks may not turn out to be as expected. There are also chances that a stock may not perform well in the long run. Now, this is called the ‘value trap.’ Moreover, an equity stock may also take a lot of time to realize its full value, which means the investors will have to wait for years to earn profits on their investments.

10. DSP Equity Opportunities Direct Plan-Growth

The scheme will generate long term appreciation form a portfolio constituted of equity and equity-related securities of large and midcap companies. The primary objective of the fund is long term capital appreciation with a portfolio of equity and equity-related securities of large-cap and midcap companies. This scheme adapts with the changing market trends because of the flexible management which ultimately keeps balancing the portfolio composition to maximize performance. Investors who have a long term financial goal can invest in this fund. However, it is advised to keep the investment for at least 5 years. If you are an investor who wants to invest in a mix of mid-cap and large-cap stocks or mid-cap stocks, then this will be a good option for you. Investors who are looking to invest in highly liquid stocks can also apply for this fund scheme. Recommended: What is Nifty and Sensex? Stock Market Basics For Beginners This fund follows an opportunistic investment approach with aggressive sectoral & stock positioning to maximize performance without affecting the diversified nature of the scheme. That’s it, I hope this guide will help you in selecting the best Direct Mutual Funds you can invest in India (2022). But if you still have any questions then feel free to ask them in the comment section.